Finmechanics Ranked in Chartis Top 15 and Wins FX Analytics Award

Finmechanics has been ranked among the Top 15 firms in the 2025 Chartis Quantitative Analytics 50 and awarded for FX Pricing Analytics. This recognition highlights our continued innovation in derivatives pricing and our commitment to delivering the first end-to-end digital solution for capital markets trading, distribution, risk management, and processing. QuantitativeAnalytics50 2025: Ranking and award […]

FM Converge

Go Agile

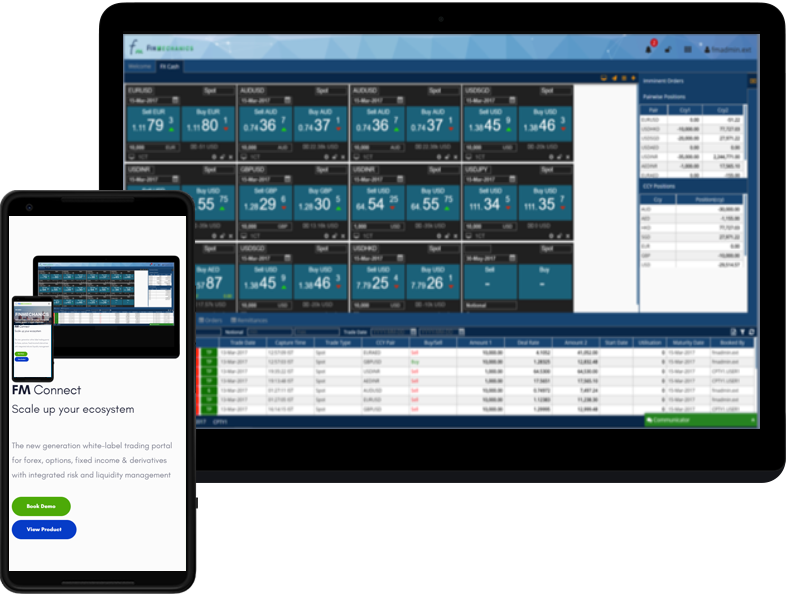

FM Connect

Scale up your ecosystem

The new generation white-labelled web trading platform for forex, options, fixed income & structured products with integrated risk and liquidity management

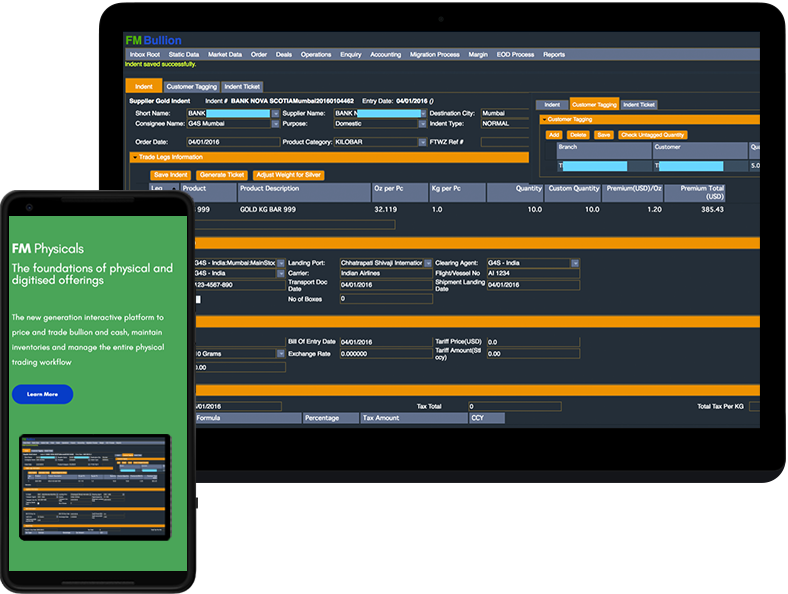

FM Physicals

The foundations of physical and digitised offerings

The new generation interactive platform to price and trade bullion and cash, maintain inventories and manage the entire physical trading workflow

The Finmechanics Advantage

Architecture & Integration Services

- System Integration

- Data/Library Integration

- Business Process Simplification

MicroServices Architecture

- Move to Cloud

- Simplified Integration

- High Performance

- Client-friendly Upgrades

Agile Delivery

- High Performance Squads

- Quant/Dev Expertise

- Regulatory Compliance

“As the Finance Industry has come to live through a state of constant change and operational churn, Finmechanics developed a new approach for banks to architect more resilient, flexible and cost efficient infrastructure. Our ultra-modern micro-service based system architecture allows them to address their regulatory and operational needs, timely, with minimum impact on their architecture, and to truly work on the cloud.”

Anindya Sarkar

CO-FOUNDER & CEO

“To achieve this, it was not only necessary to develop risk, valuations and trade processing functionalities using the very latest components available today, we also have promoted a unique spirit of innovation, participation, and excellence across our company. The Finmechanics squads are focused on functional topics and each team is tasked to championing specific technology initiatives. It all results in speed, accuracy and a sense of partnering with our clients to keep together at the cutting edge of digital technology.”